There are a lot of confusing things in life- for instance, putting together IKEA furniture or figuring out why anyone would buy a PT Cruiser. Unfortunately, choosing the right mortgage is also frequently on this list. (This is the part where I wish I could tell you it doesn’t have to be… but it is.)

Fortunately, there are some tips for making it a little easier to pick a mortgage that makes sense for you.

1. Know how much you can afford

We cannot emphasize this enough- know how much you can actually afford before agreeing to a mortgage for any amount.

You’ll realize your mistake soon enough if you don’t take into account the fact you’ll be pre-approved to borrow more from a lender than you can actually afford month to month.

This is because when lenders pre-approve you, they only look at your income, your current loans, and your credit score- they don’t consider how often you go out to dinner, how much you need for gas and car repair costs, or health care, to name a few.

To find out how much you can truly afford we suggest attending a Homebuyer Education Course and getting one-on-one financial coaching.

At the class, you’ll complete worksheets to determine how much you can comfortably afford. A housing coach will help you determine a mortgage payment that makes sense for you.

Sign up for Homebuyer Education today!

2. Check & fix your credit report

Make sure to check your credit before meeting with lenders. The lender uses your credit score to understand you as a borrower and your likelihood of repaying the mortgage- and makes a decision on your interest rate.

Remember, while this may seem like an additional hassle, ten points higher or lower on a credit score could mean thousands of dollars difference in interest paid over the lifetime of a mortgage.

You can get a free credit report:

Call Equifax: (800) 685-1111; TransUnion: (800) 916-8800; Experian: (800) 682-7654 or visit: www.annualcreditreport.com. Under federal law, these agencies are required to provide you with a free copy of your credit report once every 12 months.

Once you’ve received it:

- Check it for any errors or inconsistencies and send a letter to get them straightened out.

- Other relatively easy things to do include settling collection debts and paying down credit cards.

If you’ve got minor credit problems or blemishes on your report due to unique circumstances such as illness, make sure to explain your situation to a lender or broker.

Don’t assume a bad credit report will guarantee you a high-cost loan; ask lenders how your past credit history affects your loan estimate and what can be done to get a better price.

T o receive financial coaching to improve your credit score, sign up for our Homebuyer Education Course and get free, one-on-one coaching sessions through NeighborWorks of Western Vermont.

o receive financial coaching to improve your credit score, sign up for our Homebuyer Education Course and get free, one-on-one coaching sessions through NeighborWorks of Western Vermont.

3. Shop around

When it comes to mortgages, you should take advice from the 1960s Motown group The Miracles: “Shop Around.”

The interest rates, points, and fees will vary bank by bank.

It’s important to get more than one quote.

This advice is not new, but its seems that Americans are already so overwhelmed by the homebuying process that they fail to listen. The Consumer Financial Protection Bureau has found that almost half of American homebuyers seriously consider only one broker or lender when applying for a mortgage.

So, make it easy on yourself. We suggest starting online- many lenders now have online calculators to create estimates for you.

When you do start visiting banks and lenders, make sure to visit more than one before deciding. The interest rates, points, and fees will impact your bottom line for years to come.

4. Compare all the costs

UGH- We hope you like paperwork with tiny numbers and confusing jargon! This part is not fun nor simple, but it’s incredibly worthwhile.

There are several important numbers to consider and compare when you receive a mortgage estimate- let’s break it down.

Interest Rate:

This is the cost of borrowing money from a lender. In Vermont, it’s currently stable at 3.94% for the average 30-year fixed rate mortgage; however, the rate offered to you by a lender may vary based on your credit score; the home’s location, price, and loan amount; your down payment; the term of the loan; the type of interest rate; and the loan type.

Points:

Points are 1% of the amount being mortgaged that can be charged by the lender or opted for by the borrower. So, for a $150,000 mortgage, a point is $1,500. Your lender may charge you origination points to cover the costs of making a loan. You may buy discount points to lower your interest rate on your mortgage (think of it as pre-paying interest on your loan).

You can figure out if buying discount points makes sense for you by considering how long you’ll be in the home you’re mortgaging. A general rule of thumb is: the longer you plan to stay, the more it makes sense to buy discount points- it often takes over five years for them to pay off.

To make it easier to compare loans, ask your lender to express points in dollars instead of percentages. Bring this sheet along with you to make sure you are making notes of all the important numbers.

Closing Costs & Fees:

These fees are any costs associated with your home purchase and mortgage transaction. Generally, they add up to 2-5% of your home’s purchase price. There are many closing costs, so ask your lender to separate bank fees from the third party fees so that you know who is charging what.

- These include: Government recording costs, Appraisal fees, Credit report fees, Lender origination fees, Title services, Tax service fees, Survey fees, Attorney fees, Underwriting fees

These are included on loan estimates, so be sure to compare them against other loan estimates. Also, many of these fees are negotiable (such as the application fee, the loan origination fee, tax servicing, underwriting fees) and the seller may be willing to pay for a portion- it doesn’t hurt to ask!

5. Check the APR

Okay, so this is really part of number 4, but we wanted to make it really clear- this is important: COMPARE ANNUAL PERCENTAGE RATES.

The APR:

provides a comprehensive picture of the loan that would be lost if you just looked at the interest rate. It includes the interest rate, points, broker fees, and other credit charges that you may have to pay, displayed as a yearly rate.

Why does this matter?

Some lenders offer lower interest rates but make up for it with higher costs elsewhere. When you compare APRs between loan estimates, you get an idea of the holistic picture of a loan. For instance, consider these two scenarios:

“A $100,000 30-year fixed-rate loan with an interest rate of 3.85%, where the lender charges two points, a 1% origination fee and $1,500 in other closing costs, has a 4.215% APR.

The same loan at 4.05%, with no points, a 1% origination fee and $800 in other closing costs, has a 4.199% APR.”

The first mortgage has a lower interest rate, but it will actually end up costing you more in the long term and has higher closing costs. When you compare the APR, you can see the difference.

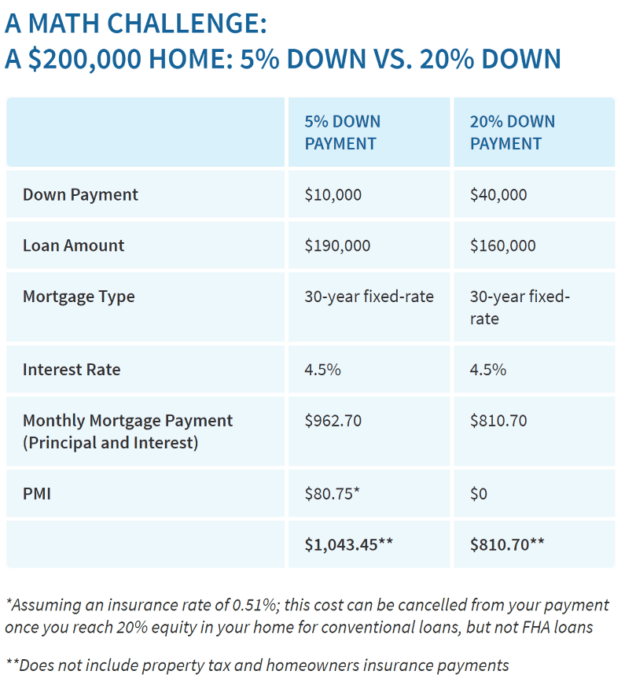

6. Avoid Private Mortgage Insurance

Mortgage lenders often require between 3%-20% of the home’s purchase price as a down payment:

- Conventional Loans: sometimes as little as 5% down payment

- Federal Housing Administration loans: 3.5% down payment

- Freddie Mac’s Home Possible Advantage product: 3% down payment

- USDA loans: There are certain income guidelines, but no required down payment

- VA loans: These are for veterans or those who have served in the military, and require no down payment

However, when you’re bringing less than 20% of the home’s purchase price to the table, lenders consider you a riskier borrower and will insist on private mortgage insurance.

This insurance protects the lender (not you) in the case you’re not making payments on your mortgage, and adds to your monthly payments until you’ve reached a certain threshold of equity (usually 20%).

If Private Mortgage Insurance (PMI) is required:

- Ask what the total cost of the insurance will be

- Ask how much your monthly payment will be when including the PMI premium

- Ask how long you will be required to carry the PMI

Down Payment Assistance

Alternatively, you could use a Down Payment Assistance (DPA) Loan. A DPA loan is a second mortgage often loaned by a separate lender that takes on the riskiness of that 20%- so you can combine two loans to create a mortgage that works for you.

You may be thinking, but a second mortgage will just increase my monthly payments as well, so why bother? Because a Down Payment Assistance loan means you’re building equity in your home, not paying insurance money to cover a lender’s risk.

Learn more about our Down Payment Assistance Loan

First Steps:

This is a lot of information to mull over- we suggest starting with a Homebuyer Education Course. Check out the schedule and sign up today!

Sign up for Homebuyer Education today!

Check out LoanWorks’ Lending Products

Contact our Lender, Amanda Moore, today with any questions you may have or to get an estimate for a mortgage or a Down Payment Assistance loan!

[email protected]

802-797-8106

Ready to start looking at properties?

Did you know we have a full-service Real Estate office within NeighborWorks of Western Vermont? Get a real estate agent who will look out for nothing except your best interests. Read more about our non-profit RealtyWorks here.